Covid Driven Vacation Home Boom in America Now Ending in 2022

In accordance to nationwide house broker Redfin, need for trip homes in the U.S. has dropped sharply for the second month in a row in March 2022, with home finance loan-price locks for second residences at their lowest degree considering that May well 2020.

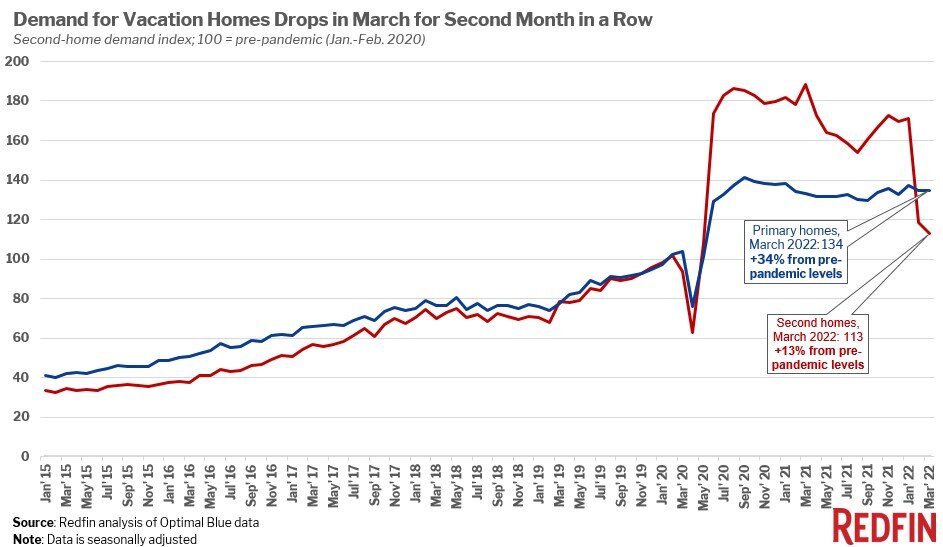

Demand for family vacation houses was even now up 13% from pre-pandemic ranges, but it really is declining immediately after a pandemic-fueled 2nd-household increase final 12 months. Nevertheless, Redfin expects demand from customers for second households to remain earlier mentioned pre-pandemic concentrations in the long term, as remote get the job done is below to remain for lots of Americans.

The slowdown in demand from customers for getaway homes joins other early alerts that the traditionally quick increase in home loan costs and document-high household rates are pricing out some buyers.

“The pandemic-pushed surge in profits of vacation residences is coming to an end as house loan costs increase at their quickest pace in record, triggering some 2nd-house potential buyers to back off,” claimed Redfin Deputy Main Economist Taylor Marr. “When rates and rates shoot up so much that a vacation residence starts off to look extra like a burden than a good expense and a fun location to convey your family members on the weekends, a large amount of prospective prospective buyers have next feelings. The new next-home bank loan charges that kicked in on April 1 were also a deterrent. As well as, some buyers’ down payments–and their nerves–probably took a strike when the inventory industry dipped more than the very last number of months.”

Expansion in desire for most important residences outpaced that of 2nd households for the next thirty day period in a row, with house loan-level locks for primary residences up 34% from pre-pandemic concentrations. Demand for most important residences has remained at roughly the similar degree given that June 2020.

Desire in vacation residences skyrocketed in mid-2020 as lots of affluent Us residents begun doing the job remotely and home finance loan premiums dropped to history lows, with home finance loan-charge locks for second properties reaching a peak of 88% higher than pre-pandemic degrees in March 2021. Need declined sharply about the last two months as home finance loan rates shot up at their swiftest speed in heritage, achieving 4.67% by the end of March, and some employees started out returning to the office environment.

A different deterrent to desire was the impending rise in financial loan fees for second-home financial loans, which increased by about 1% to 4% beginning on April 1. The transform adds about $13,500 to the price of obtaining a $400,000 household for the common family vacation-dwelling purchaser and will keep on to interesting interest in trip households in the coming months.